【GameLook Zhuangao, do not reprint without authorization!】

GameLook Report/In the past year, there have been many big changes in the game industry: from the implementation of the most stringent new policy to prevent game addiction, to the failure to release the game version number for 5 consecutive months… It has profoundly changed the trend of the entire game circle. It is not only reflected in the game development process, but also in the changes in the entire mobile game purchase market.

Recently, the DataEye Research Institute released the “2021 Annual Mobile Game Purchase White Paper”, which retrospectively reviewed the history and trends of the mobile game purchase market in the past year from a data perspective.

In simple terms, due to factors such as the suspension of version numbers, the number of materials, games, and companies surged in the second half of the year, driving a significant increase in the cost of purchases. Under this circumstance, hyper-casual and online earning games, which are quickly monetized by advertising, have risen rapidly. Compared with 2020, the number of games released by the latter has even skyrocketed by 286.18%.

Not only that, but the distribution channels have also changed: the pangolin alliance and Douyin under the Byte series are in the lead and become the main battlefield for purchases. This article will share and interpret some of the content.

The suspension of the version number intensifies the competition for purchase volume, and the delivery time node is more critical

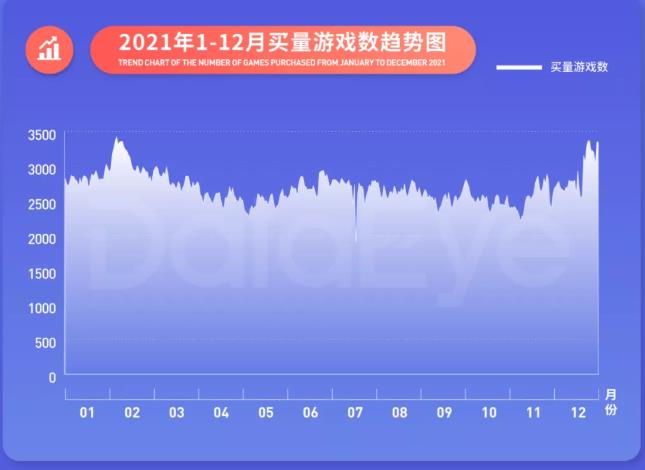

The “White Paper” pointed out that due to factors such as holidays and industry regulation, the amount of materials purchased in a single day fluctuated greatly. In terms of the placement trend of purchased materials, since June entered the summer season, the number of placements began to increase. Then, the release of the July edition number was postponed, which led to the increase in the amount of materials delivered in the second half of the year.

Among them, before the implementation of the “Strictest Game Anti-Addiction New Deal” in September, the single-day delivery of materials once again broke the peak record. Until December, affected by the intensified competition in buying volume, the amount of material put on New Year’s Eve reached the peak of the year.

Overall, the number of games purchased during the year did not change much. During the Spring Festival in February, nearly 3,500 games were launched at the same time in a single day. Then, in December, which was approaching New Year’s Day, in order to seize users in advance, the number of purchased games again approached the Spring Festival record.

Specifically, the number of monthly launches is as high as 6,000 models, which is higher than the level of 4,000 models in 2020. Also in December, the number of launches reached a peak of 7,184 models. That is to say, game purchases are now greatly affected by holiday time nodes.

As for the main body of buying companies, it can be clearly seen that the number of buying companies has increased significantly, marked around July. It can be seen that, affected by the regulation of the total number of version numbers, game companies are forced to focus on the long-term operation of old products, trying to achieve the purpose of attracting new players or recalling old players through a large number of purchases.

Obviously, from the perspective of time, the amount of material and the number of advertisers have increased significantly in the second half of the year. This also means that the competition for game purchases has become increasingly fierce, and it has begun to focus on important time points such as holidays. Taking the concentrated outbreak of December as an example, it has even bought a month in advance to seize the user market.

Leisure and online earning categories are on the rise, with the latter soaring by 286.18%

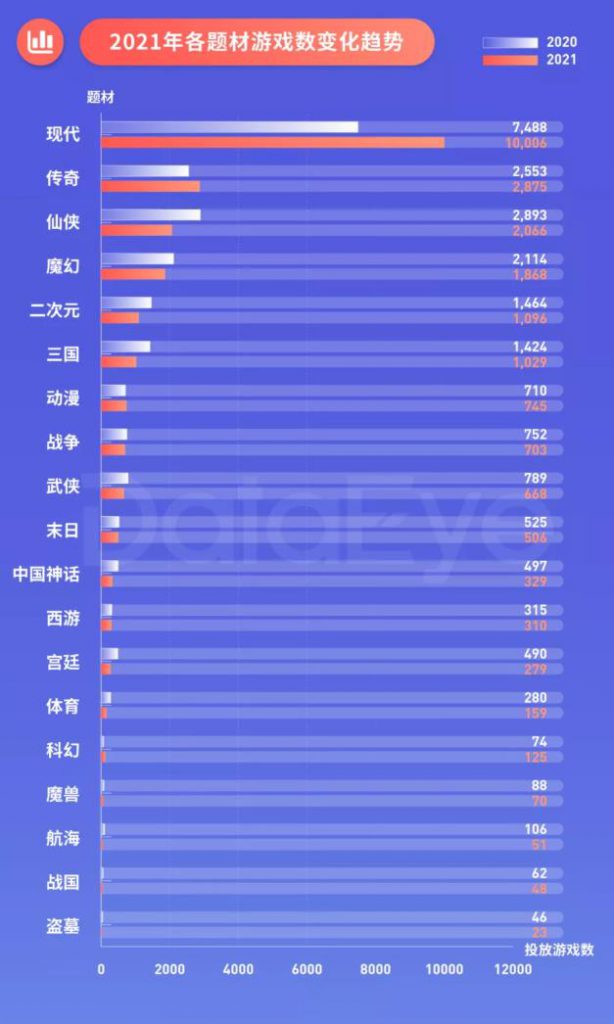

In terms of the proportion of specific themes, modern themes almost accounted for nearly half of the buying market, accounting for 46.41%. Even the past “big buyers” Legend, Xianxia and Magic accounted for only 13.33%, 9.58%, and 8.66%. After the three are added, there is still a big gap from the former.

Looking further, compared to the previous year, there has been a substantial increase in modern themes. From 7,488 models in 2020 to 10,006 models, a year-on-year increase of 33.63%. In contrast, both Xianxia and magic themes will decline slightly in 2021, while the legendary category will increase from 2553 to 2875, a year-on-year increase of 12.61%.

In terms of the overall delivery trend, modern theme products have made a strong investment in purchasing materials, and there has been a significant increase in the period from May to October. But even in March-May, when the buying volume was the most sluggish, other categories were still out of reach.

In terms of gameplay, MMORPG still plays the role of “big brother” with a high proportion of 32.90%. But the difference is that in 2021, leisure and online earning games will emerge suddenly, and the proportion of investment is second only to the former, accounting for 23.37% and 8.56% respectively. The three almost dominate the entire purchase market.

Continuing to compare with 2020, MMORPGs are still generally stable, but the number of games released has declined slightly. It decreased from 8024 in the previous year to 6441, a year-on-year decrease of 19.73%. In contrast, the leisure and online earning categories will see a large number of game launches in 2021.

Among them, casual games increased from 3512 to 4575, a year-on-year growth rate of 30.27%. And online earning games have grown significantly, from 434 to 1,676, with a year-on-year growth rate of 286.18%.

In GameLook’s view, behind the rare surge in online earning games, it is obviously affected by the delay in the release of the version number. From the perspective of the release trend, since August, the number of materials posted in online earning games has soared from less than 20,000 to nearly 60,000. groups, and even nearly 2 times that of MMORPGs. Similarly, because such games focus on modern themes, it naturally drives the increase in the scale of their purchases.

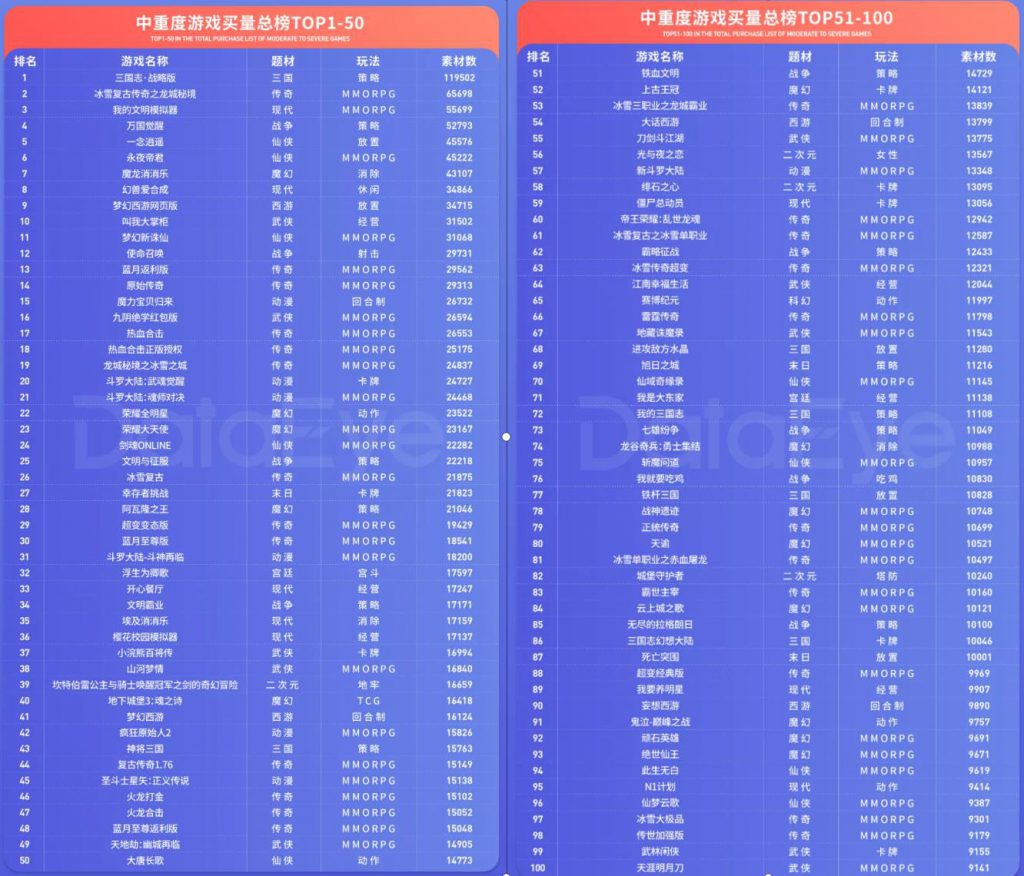

Leisure and online earning companies dominate, and byte systems become mainstream channels

In addition, the “White Paper” also lists the purchase volume of medium-to-heavy game products in 2021, of which strategy games and MMORPGs occupy the TOP10. “Three Kingdoms: Strategic Edition” still ranks first, but there are also new games such as “Call Me Big Shopkeeper” and “One Thought”. In the top 100 products purchased, MMORPG still accounts for half. From the perspective of themes, Xianxia, magic, martial arts, two-dimensional and other categories frequently “swipe their faces”, showing a trend of diversification as a whole, but legends are still the main buying force.

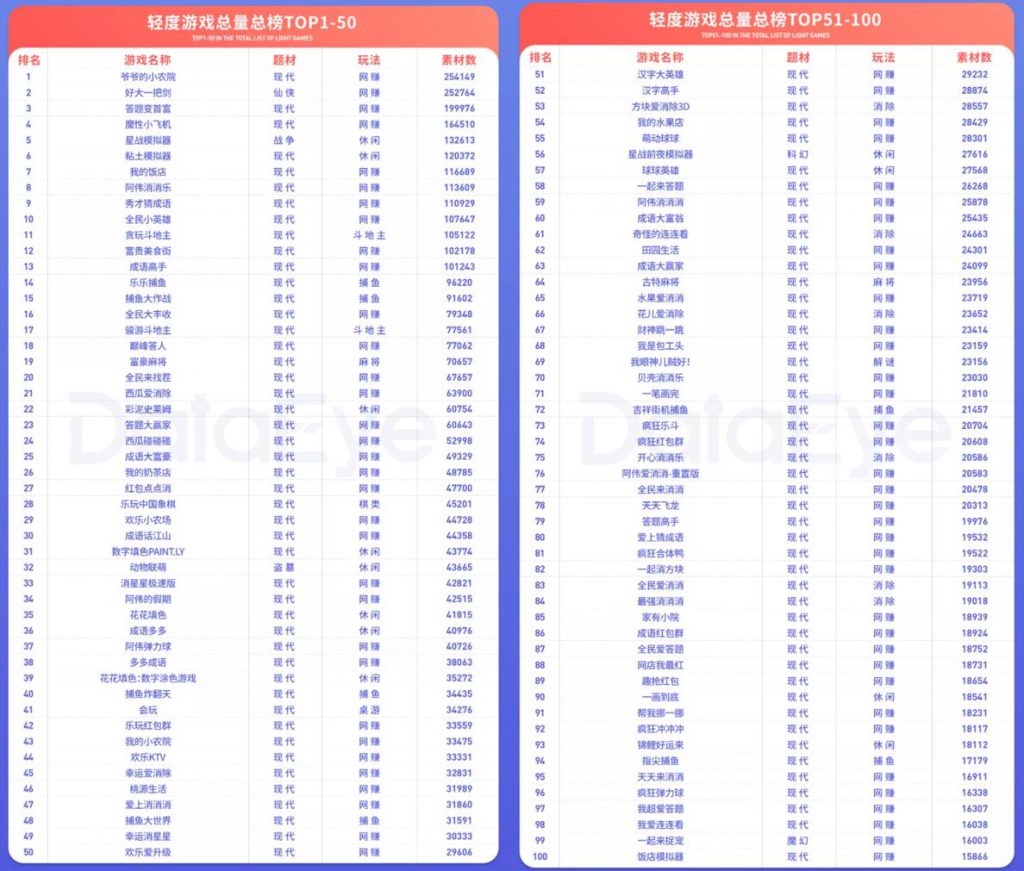

It is worth mentioning that this year’s “White Paper” also specifically listed the TOP100 light games. In terms of themes, it is completely dominated by modern themes, but in terms of gameplay types, it has almost become the “outstanding star” of leisure and online earning games, accounting for more than 90% of the places. Among them, the number of materials for TOP3 far exceeds that of “Three Kingdoms: Strategy Edition”, which is the first major game. In particular, “Grandpa’s Small Farmhouse”, which ranked first, posted as many as 250,000 sets of materials, which was more than twice that of the former.

In terms of the main body of investment, the previous year was almost dominated by big companies such as Tencent and NetEase, but 2021 has undergone earth-shaking changes. The first is that after the big game companies were squeezed to the TOP14, most of the top ten companies are game companies that mainly focus on leisure and online earning.

For example, Fuzhou Laiwan Huyu, which ranks first, focuses on leisure and online earning games; TOP2 is a huge engine of Byte; the third Kuaishou parent company, Beijing Huayi Huilong, also tends to be leisure. With the launch of online earning games. At the same time, the “White Paper” shows that the first three materials accounted for nearly 44%, which almost dominated the entire buying market.

But specific to a single category, take the online earning games with skyrocketing numbers as an example: it can be seen that a single company, the TOP1 Fuzhou Laiwan Entertainment, is still dominated, and the head effect of buying volume is still obvious.

In terms of purchasing channels, compared to last year’s Tencent and the byte series, this year is completely the “leader” of the byte series. Thanks to the popularity of short videos and information apps, its Pangolin Alliance, Toutiao and Douyin occupied the top three positions in the first echelon. On the other hand, Kuaishou quickly rose to the top of the second echelon with the rise of leisure and online earning games, and followed closely behind. On the other hand, Tencent’s excellent advertising, Tencent Video, Tencent News, and Tiantian Express dropped to TOP6-9. In addition, mobile phones such as Baidu, Hupu, and Station B are outside the TOP10.

As far as the material content is concerned, it is not difficult to find that it is obviously more and more dependent on the creativity and quality of short videos, and the content is mainly derived from amateur plots, hot stalks, stars and talent anchors, etc. Among them, live-action appearances and 3D production are dominant, which further leads to higher purchase costs and human input, and competition is more intense.

This Article is curated from Source and we only provide the English version of the Story.