[GameLookspecialmanuscriptnoreprintwithoutauthorization!】

GameLook report/Since the rise of Apple’s App Store and Google’s Google Play two mainstream mobile digital app stores, mobile apps have become a gold rush for many developers, and now with the rapid development of the mobile game industry, mobile games have also become Two important sources of revenue for digital stores.

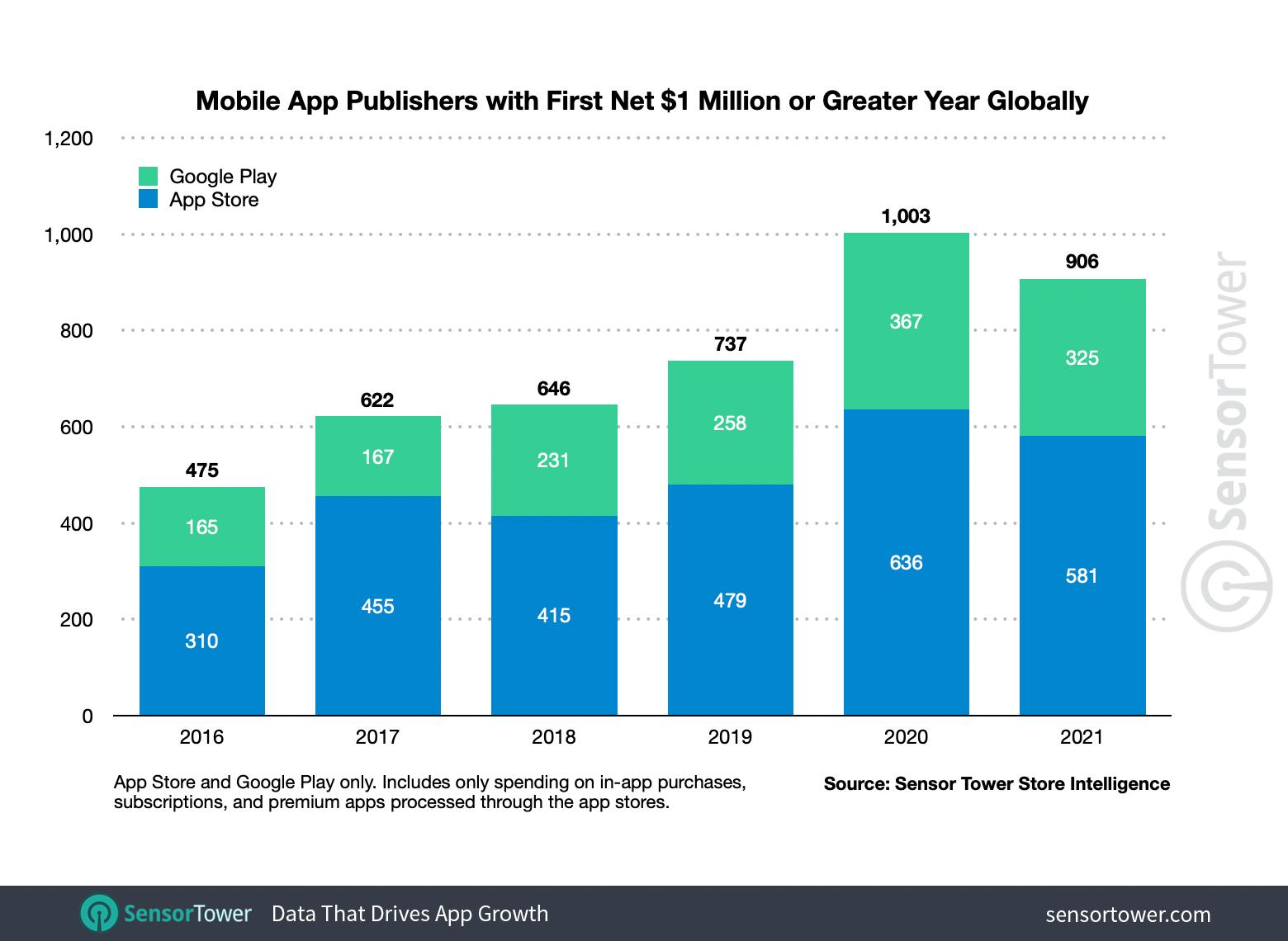

Recently, according to data provided by the Sensor Tower blog, in 2021, more than 900 publishers worldwide are expected to reach this milestone on the App Store and Google Play, an increase of nearly 475 compared to 2016. 91%.

Among them, only 581 iOS publishers had net income of USD 1 million or more, an increase of 87% from 310 in 2016.

A similar trend has also appeared in Google Play. The number of publishers reaching or exceeding one million dollars has increased from 165 in 2016 to 325 this year, an increase of 97%, which is 6 percentage points higher than that of the App Store. .

The following is the Sensor Tower blog content compiled by GameLook:

In the post-epidemic era, the market gradually returns to normal

Although consumer spending continues to show an increasing trend, publishers who have exceeded the million-dollar net income milestone for the first time so far are expected to see a certain decline. This is likely to be affected by the high base in 2020, and the number of new app downloads After the explosive growth, it gradually returned to normalization.

According to the number of downloads counted by Sensor Tower, during the epidemic, the number of new applications installed by users reached an alarming level, and fewer users tried to install new applications this year than last year.

In 2020, the annual net income of a total of 636 publishers in the App Store exceeded $1 million for the first time, and in 2021, this number has fallen by 9%. Similarly, last year, 367 publishers in Google Play reached the million-dollar milestone for the first time, but this year only 325, a year-on-year decrease of 11%.

In addition to this, another obvious trend is that the gap between app stores is shrinking.

Although there are a lot more publishers reaching the $1 million milestone on the App Store each year than in Google Play, it is obvious that the gap between the two is gradually narrowing. In 2017, the gap between the two reached its peak. At that time, the circulation in the App Store was 2.7 times that of Google Play, and this year it has shrunk to 1.8 times.

From another perspective, this actually reflects the growth rate of user spending on the Google Play platform. In 2021, users are expected to spend US$47.9 billion on Google Play, a year-on-year increase of 23.55%, while consumer spending on iOS is US$85.1 billion, a year-on-year increase of 17%. Obviously, Google Play’s growth rate is 6% higher. Percentage points.

Games still account for the majority, and “productivity” and “communication” apps are gradually developing

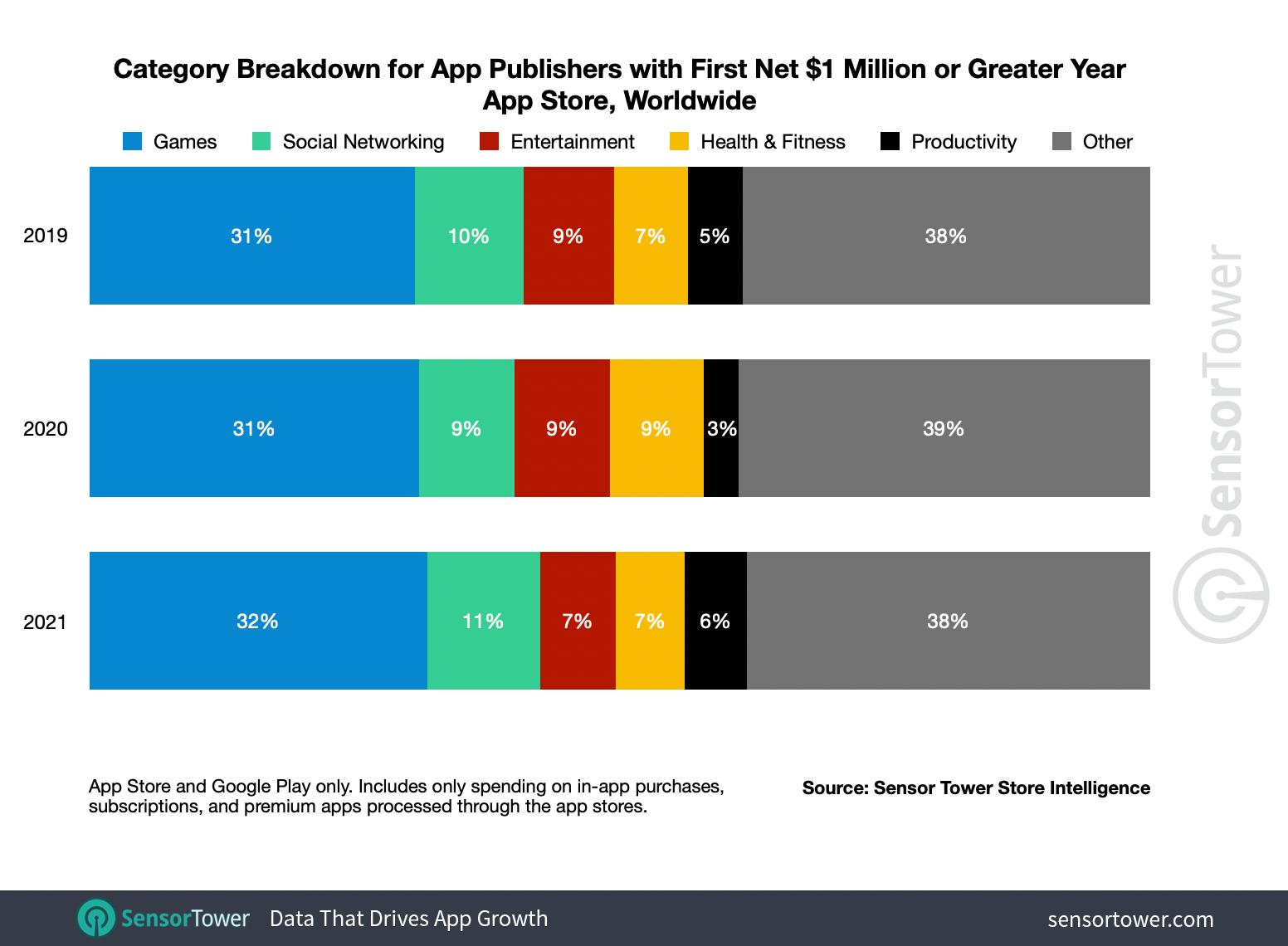

All the time, among all publishers that broke through one million dollars for the first time, game publishers have accounted for the vast majority. Since the beginning of 2019, social and entertainment applications have begun to follow closely. In 2021, this One point will continue.

According to Sensor Tower data estimates, 185 mobile game publishers reached the million-dollar net revenue milestone for the first time this year, accounting for about 32% of all publishers that exceeded the million-dollar for the first time, followed by social, with a total of 62 social app publishers. Revenue exceeded the million-dollar mark for the first time, accounting for 11% of the total, and in the entertainment category, a total of 41 publishers reached this number, accounting for 7% of the total.

However, in terms of growth rate, productivity and sports apps have undergone significant changes in 2021. Last year, in the productivity category, a total of 21 publishers reached the million-dollar net income milestone for the first time, accounting for about 3.3% of the total, and this number climbed to 34 this year, accounting for about 6% of the total. In the sports category, the number of publishers whose net income exceeded one million for the first time increased from 5 in 2020 to 18 in 2021, accounting for about 3% of the total.

In contrast, the share of games has dropped by 31% compared to nearly 63% in 2016. Of course, this is mainly due to the emergence of new categories in the market over time and the gains made by publishers in these non-game categories. A major success.

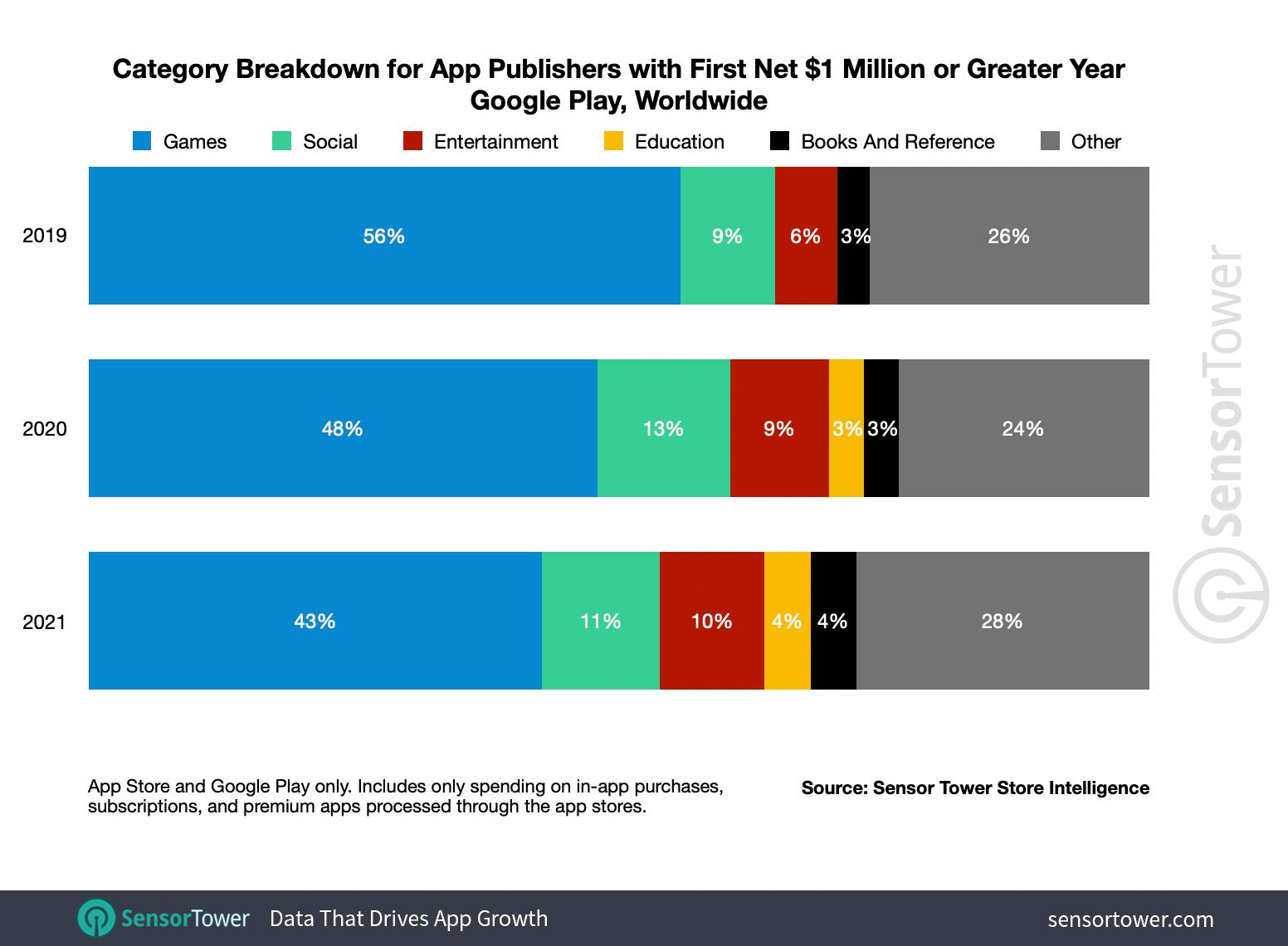

The situation of Google Play is similar to that of the App Store. Games account for most of the market share of apps with net income of more than one million U.S. dollars in Google Play. In 2021, 139 publishers are expected to reach this milestone, accounting for about 43% of the total; the second largest publisher is social, with a total of 36 publishers reaching this milestone, accounting for about 11% of the total. ; Entertainment category ranked third, a total of 32 publishers achieved this achievement, accounting for about 10% of the total.

Compared to 2020, this year’s communication applications are the fastest growing category, with a growth rate of 84%. The number of publishers that exceeded one million dollars for the first time has risen from 6 to 11, accounting for about 3.4% of the total.

Similar to the App Store, game publishers with revenues of more than one million dollars in Google Play have been declining in recent years. In 2016, about 124 game publishers had revenues of more than one million dollars, accounting for 75.2% of the total. In 2021 In 2009, a total of 139 game publishers had revenues exceeding one million U.S. dollars, but their total proportion fell to 42.8%.

Global trendsU.S. market fulfilled

Sensor Tower predicts that in the U.S. market, publishers with revenues exceeding one million dollars for the first time will drop from 446 in 2020 to 408, a decrease of approximately 9%. Among them, 274 are expected in the App Store market, a 10% decrease year-on-year. In the Google Play market, there will be 134 companies, a year-on-year decrease of 6%.

It can be seen that the gap between the App Store and Google Play in the U.S. market is gradually narrowing, but Apple still maintains a leading position, and the number of new publishers with annual revenue of over one million will double.

In addition, mobile game publishers with revenue exceeding one million dollars for the first time accounted for the largest share in the US market. Among them, in the US App Store, 60 publishers are expected to achieve this achievement this year, accounting for the first time that all revenues exceed one million. 22% of the application, and 62 publishers will reach it in Google Play, accounting for about 46%.

It can be seen that new publishers born in the Apple App Store with revenue exceeding one million are still in the leading position, but as the rate of consumer spending on Google Play is accelerating, this may cause the gap between the two platforms to be further narrowed. .

Of course, the mobile application store is undergoing major changes in recent years. With the opening of third-party payment options for applications on some platforms, the platform’s revenue is likely to be variable. Will this affect the App Store and publishers on Google Play? , You need time to further answer.

This Article is curated from Source and we only provide the English version of the Story.